The ESG Dilemma in Indonesia’s Metal & Others Mineral Firms: Evaluating Corporate Social Responsibility and Good Corporate Governance Effects the Financial Performance

Dilema ESG pada Perusahaan Logam & Mineral Lainnya di Indonesia: Evaluasi Dampak Corporate Social Responsibility dan Good Corporate Governance terhadap Kinerja Keuangan.

DOI:

https://doi.org/10.47663/ibec.v4i1.328Keywords:

Corporate Social Responsibility, Financial Performance, Good Corporate Governance, Indonesia Stock Exchange, Mining IndustryAbstract

This study examines the impact of Corporate Social Responsibility and Good Corporate Governance on Financial Performance in Indonesia's metal and mineral mining sector from 2021 to 2024. Through quantitative analysis of secondary data from eight companies' financial, sustainability, and annual reports, multiple linear regression was employed alongside classical assumption tests and hypothesis testing. Results demonstrate that both variables significantly enhance Financial Performance individually and collectively. The t-test value for Corporate Social Responsibility was 2.258 and Good Corporate Governance was 3.353 surpassed the critical value of 2.0423 at significance levels below 0.05, while the F-test result of 18.450 (p < 0.001) confirmed their combined effect. With an R² of 0.560, these factors explain 56% of performance variance, indicating their substantial influence. The findings highlight how integrating these practices into corporate strategy can improve financial sustainability and risk management, offering valuable insights for corporate leaders and policymakers in promoting sustainable mining operations, while establishing a basis for further research on additional performance determinants.

Downloads

References

Anita, & Amalia, D. P. (2021). Pengaruh Tanggung Jawab Sosial Terhadap Kinerja Keuangan Struktur Kepemilikan Sebagai Variabel Moderasi. Jurnal Ekonomi Modernisasi, 17(1), 54-68. doi:https://doi.org/10.21067/jem.v17i1.5283

Cahyaningrum, S. P., Titisari, K. H., & Astungkara, A. (2022). Pengaruh Penerapan Good Corporate Governance dan Corporate Social Responsibility terhadap Kinerja Keuangan Perusahaan. Owner: Riset & Jurnal Akuntansi, 6(3), 3130-3138. doi:https://doi.org/10.33395/owner.v6i3.1012

Dewi, D. S., Susbiyani, A., & Syahfrudin, A. (2019). Pengaruh Penerapan Good Corporate Governance, Total Asset Turn Over dan Kepemilikan Institusional terhadap Kinerja Keuangan Perusahaan. International Journal of Social Science and Business, 3(4), 473-480. doi:https://doi.org/10.23887/ijssb.v3i4.21642

Effendi, M. A. (2016). The Power of Good Corporate Governance: Teori dan Implementasi (2 ed.). Jakarta: Salemba Empat.

Firdaus, A., Mariana, Diana, Alfianti, J., Saputra, R., & Aztari, A. M. (2025). Pengaruh GCG dan CSR dalam Meningkatkan Kinerja Keuangan Bank di BEI. Owner: Riset & Jurnal Akuntansi, 9(2). doi:https://doi.org/10.33395/owner.v9i2.2672

Ghozali, I. (2013). Aplikasi Analisis Multivariate dengan Program IBM SPSS 21 (7 ed.). Semarang: Badan Penerbit Universitas Diponegoro.

Ghozali, I. (2016). Aplikasi Analisis Multivariate dengan Program IBM SPSS 23 (8 ed.). Semarang: Badan Penerbit Universitas Diponegoro.

Ghozali, I. (2021). Aplikasi Analisis Multivariate dengan Program IBM SPSS 26 (10 ed.). Semarang: Badan Penerbit Universitas Diponegoro.

Hamndani. (2016). Good Corporate Governance: Tinjauan Etika dalam Praktik Bisnis. Jakarta: Mitra Wacana Media.

Haniffa, R., & Cooke, T. (2005). The Impact of Culture and Governance on Corporate Social Reporting. Journal of Accounting and Public Policy, 24(5), 391-430. doi:https://doi.org/10.1016/j.jaccpubpol.2005.06.001

Hartanto, M. C., & Susilowati, C. (2024). Pengaruh Corporate Social Responsibility, Leverage, dan Ukuran Perusahaan Terhadap Kinerja Keuangan. Measurement: Jurnal Akuntansi, 18(1), 164-176. Retrieved from https://www.journal.unrika.ac.id/index.php/measurement/article/view/6534

Hery. (2015). Analisis Laporan Keuangan. Jakarta: Grasindo.

Lukviarman, N. (2016). Corporate Governance: Menuju Penguatan Konseptual dan Implementasi di Indonesia. Solo: PT. Era Adicitra Intermedia.

Mutianingsih, V., Usman, B., & Hartini. (2024). Pengaruh Tanggung Jawab Sosial, Kepemilikan Institusional, Ukuran Dewan Komisaris, Kebijakan Dividen, Ukuran Perusahaan Dan Leverage Terhadap Kinerja Keuangan. 5(2), 398-414. doi:https://doi.org/10.37481/sjr.v7i4.952

Naek, T., & Tjun, L. T. (2020). Pengaruh Corporate Social Responsibility Terhadap Kinerja Perusahaan Dengan Good Corporate Governance Sebagai Variabel Moderasi Pada Perusahaan Manufaktur Di Bursa Efek Indonesia Periode 2015-2017. Jurnal Akuntansi, 12(1), 123-136. doi:https://doi.org/10.28932/jam.v12i1.2323

Nainggolan, S. G. (2021). Pengaruh Penagihan Pajak Dengan Surat Tegur dan Surat Paksa Terhadap Pencairan Tunggakan Pajak pada Kantor Pelayanan Pajak Medan Timur. Jurnal Akuntansi Bisnis Eka Prasetya, 7(1), 25-34. doi:https://doi.org/10.47663/abep.v7i1.185

Nugroho, A. S., & Haritanto, W. (2022). Metode Penelitian Kuantitatif Dengan Pendekatan Statistika Teori, Implementasi, & Praktik Dengan SPSS. Yogyakarta: ANDI.

Priyatno, D. (2018). SPSS Panduan Mudah Olah Data bagi Mahasiswa dan Umum. Yogyakarta: CV. Andi Offset.

Puspita, A. D., & Kartini, T. (2022). Pengaruh Good Corporate Governance (GCG) Dan Corporate Social Responsibility (CSR) Terhadap Kinerja Keuangan Perbankan Yang Terdaftar Di Indonesia Stock Exchange (IDX). COSTING : Journal of Economic, Business and Accounting, 6(1), 330-337. doi:https://doi.org/10.31539/costing.v6i1.4059

Sahir, S. H. (2021). Metodologi Penelitian. Yogyakarta: KBM Indonesia.

Sarwono, J. (2018). Statistik untuk Riset Skripsi. Yogyakarta: ANDI.

Sirait, P. (2016). Analisis Laporan Keuangan. Yogyakarta: Ekuilibria.

Sugiyono. (2017). Statistika Untuk Penelitian. Bandung: Alfabeta.

Susadi, M. N., & Kholmi, M. (2021). The Effect Of Good Corporate Governance Mechanism Toward. Jurnal Akuntansi & Ekonomika, 11(1). doi:https://doi.org/10.37859/jae.v11i1.2515

Vebriyani, L. D., Suartini, S., & Sulistyo, H. (2023). Pengaruh Corporate Social Responsibility (CSR) dan Intellectual Capital terhadap Kinerja Keuangan . Jurnal Ekonomi, Keuangan & Bisnis Syariah, 5(4), 1862-1878. doi:https://doi.org/10.47467/alkharaj.v5i4.1917

Downloads

Published

How to Cite

Issue

Section

License

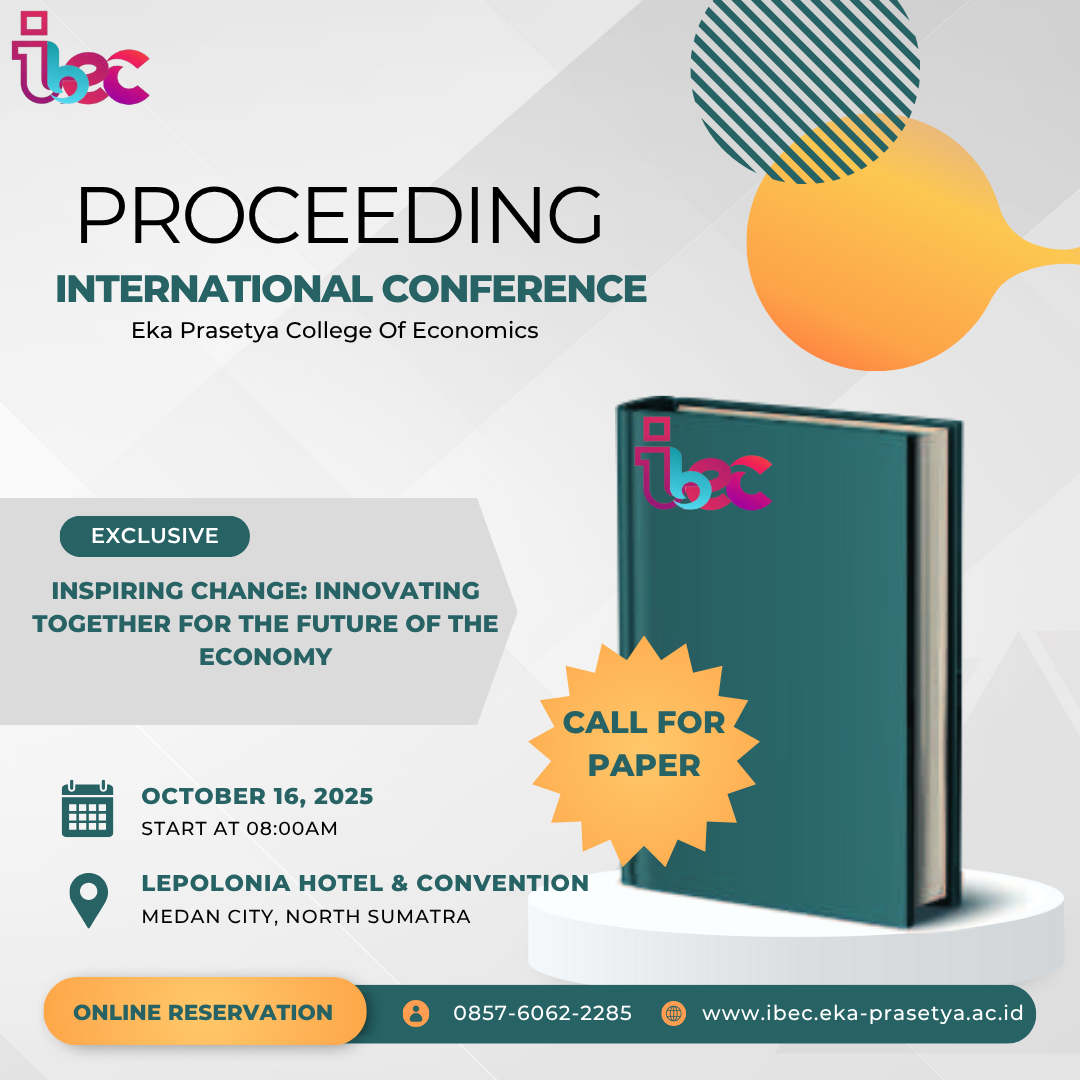

Copyright (c) 2025 PROCEEDING INTERNATIONAL BUSINESS AND ECONOMICS CONFERENCE (IBEC)

This work is licensed under a Creative Commons Attribution 4.0 International License.